LendingOne

loan origination platform

loan origination platform

Ruby on Rails

Ruby

Redis

PostgreSQL

React

Sidekiq

Total amount of submitted

applications

Loan applications

Loan approval percentage

Over the past few years, Customer Relationship Management (CRM) platforms have become increasingly important to the lending industry. Real estate lenders use these platforms to manage relationships with their customers, track leads, and nurture prospects.

LendingOne founder Bill Green approached JetRockets within a year of founding his new venture, seeking help to distinguish the company as a true fintech operation driven by cutting edge technology—not just another moneylender. To that end, the company needed to develop technology to streamline the process of reaching and processing incoming customers and creating a platform through which LendingOne employees could address their needs.

“JetRockets reviewed our requirements and really understood the depth of our business and what we were lacking. I have dealt with many different IT development project teams throughout my tenure, and their team is very well acquainted with the technology; they know what they are doing and understand the requirements thoroughly.”

Saal Siddiqi

Director of Technology, LendingOne

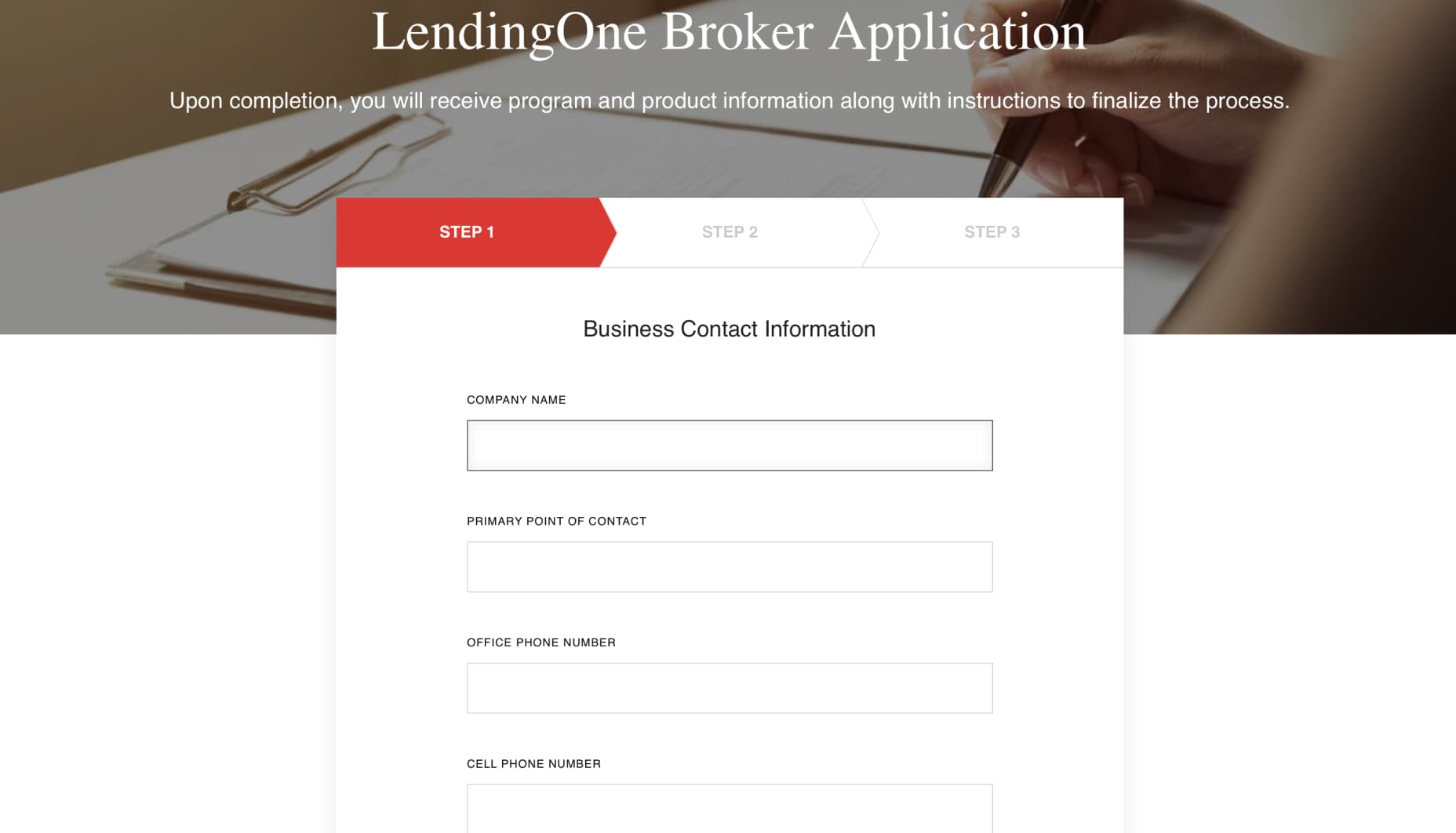

Having surveyed the field of already available out-of-the-box customer relationship management platforms (CRM), LendingOne knew that none included the special features it envisioned for its own system. To meet the company’s needs, the JetRockets team created a custom application processing platform to allow potential customers to fill out loan applications outlining their needs, which LendingOne staff could then address quickly and efficiently.

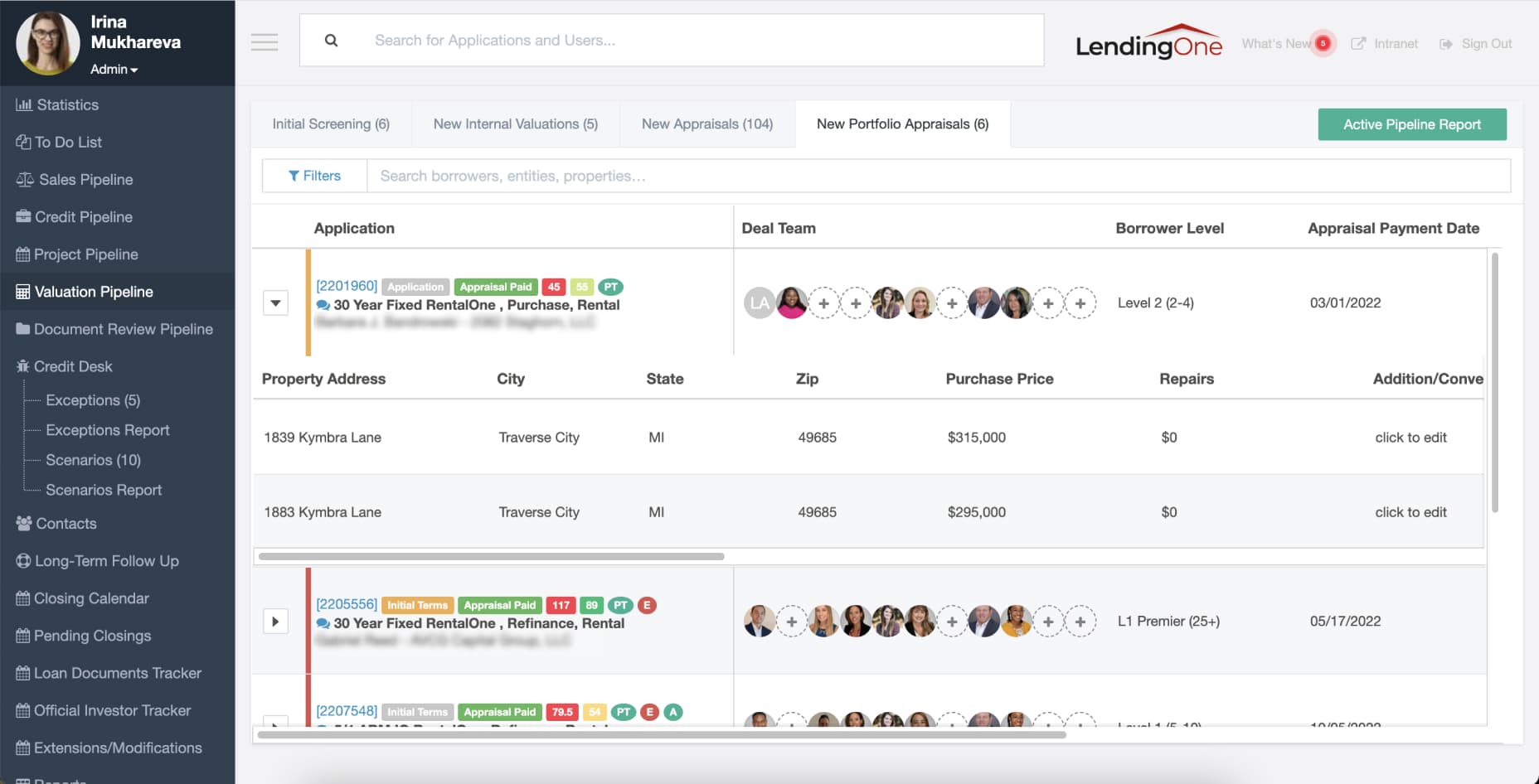

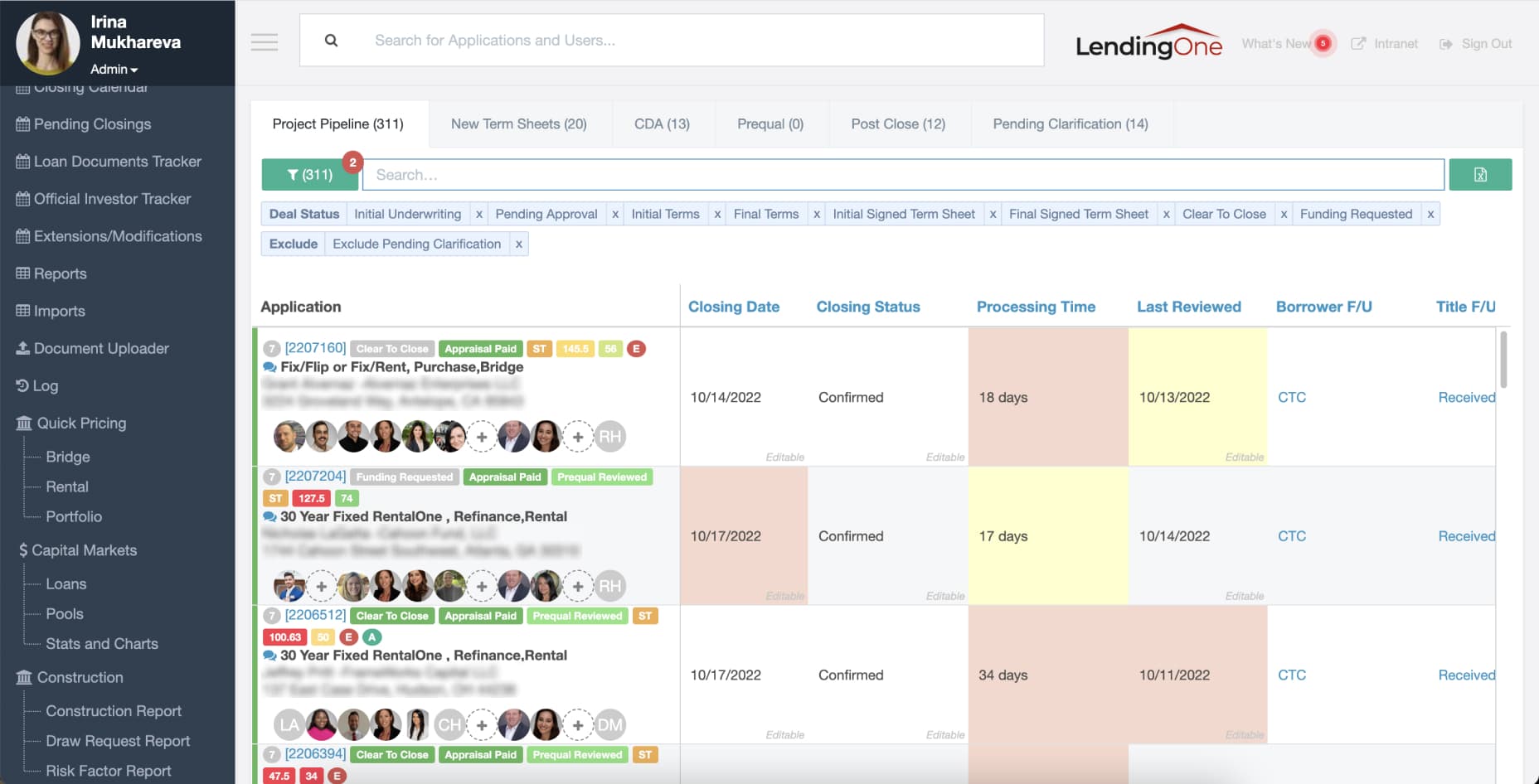

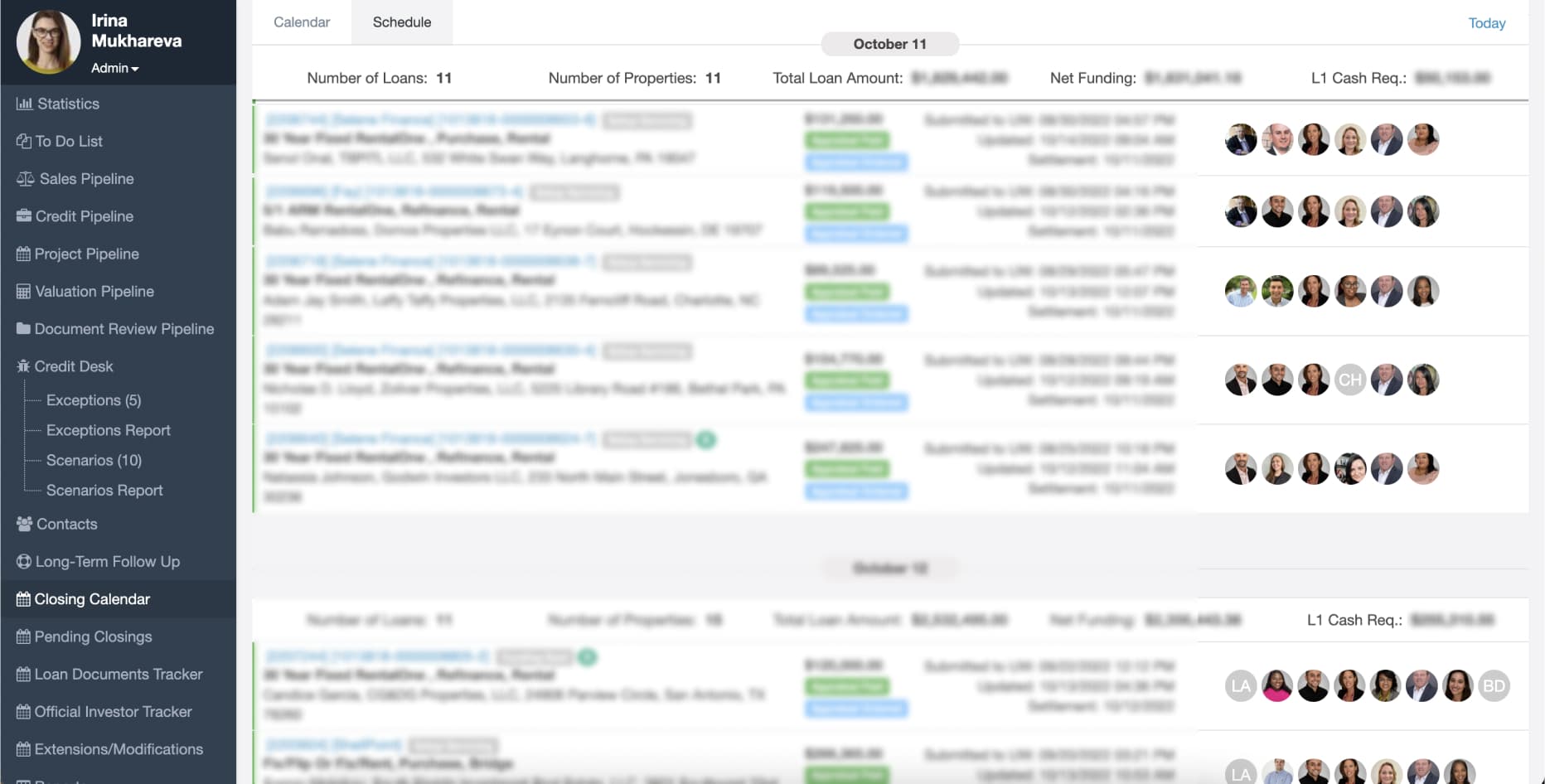

JetRockets also built a system to automate LendingOne’s loan origination underwriting procedures, including tools to verify income and conduct background checks on those submitting applications. The result streamlined the process from loan origination through information gathering, document management and the delivery of funds to clients.

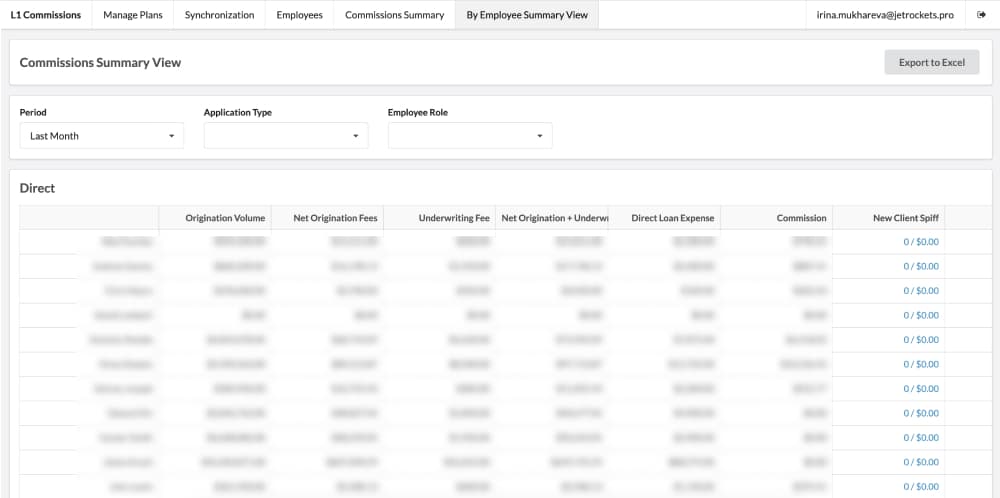

The third piece in the puzzle was expanding the platform to automatically calculate commissions for LendingOne’s sales team and loan officers.

The JetRocket team continues to work with LendingOne as its development team, building out and augmenting its technologies to grow and enhance its services for its clients and its employees, while also adjusting the company’s tools as it seeks to adapt to current industry and overall economic trends. In this ongoing process, JetRockets works closely with LendingOne’s CTO to implement new ideas on an ongoing basis.

Over the years, JetRockets has scaled its own team of developers to address LendingOne’s needs, allocating more team members during periods of intense development.

With approximately 100 employees and over a thousand different clients, LendingOne needed a CRM that could fully accommodate all users of the service and from a front and backend standpoint.

In order for the platform to be successful, it needed to be user-friendly for all users — borrowers who apply for loans, brokers who assist them, and loan origination team members who process the loans. Focusing on the Borrower experience, the JetRockets team developed a user-friendly application that allows a convenient way to perform key functions that include:

The Commissions application provides an easy and automated way to calculate sales compensation to reps and management, and accurately report on sales performance.

“The most impressive thing has been their [JetRockets] response time and coverage. They are on top of things 24/7, which is very impressive for a relatively small team. They understand the business very well, especially because they are external and are not living our business day in and day out.”

Saal Siddiqi

Director of Technology, LendingOneToday, LendingOne has over a thousand happy clients, roughly one hundred employees who are working each day to learn how to finance real estate investors faster, and lends across 43 states. Following the series of backend advancements, both LendingOne employees and clients now have a frictionless way to input and access the data they need.

“The team is knowledgeable, bright, and very talented all around. The technology business is very volatile from a timing standpoint, and I know from my experience working with various teams in the past that they are the best in the business so far.”

Saal Siddiqi

Director of Technology, LendingOneToday, LendingOne and JetRockets continue to collaborate. We provide necessary updates to the company’s technology, as well as maintain the partnership for future LendingOne projects and software advancements.

At the outset, LendingOne’s platform began as a monolithic application — self-contained and independent from other computing applications. But, over time, as more functionality was added, the JetRockets team broke the system into a web service model, with standalone web services that work in tandem through an application programming interface (API) connection to support one another.

Throughout the process of building out LendingOne’s platform, the JetRockets team integrated the company’s system with loan servicing companies, real estate appraisal firms, property search services, and other data sources that serve the real estate lending industry.

JetRockets also enabled LendingOne to integrate with services such as PayPal, Google Analytics, Mailchimp and others.