What Higher Interest Rates And Inflation Mean For Startups

The 2010’s were an incredible decade for tech startups. Interest rates and inflation were at or near historic lows, making it easy to allocate capital for all kinds of projects. Investors were willing to bet on all kinds of creative and risky endeavors, and founders had greater opportunity to pursue their dreams.

As is always the case, few startups turned into long-term success stories. But because of easy money, many projects got off the ground that wouldn’t have otherwise.

Now that we are already in the fourth year of the 2020’s, things look different. Macroeconomic conditions have changed across the board, making money tighter overall. While higher interest rates and inflation by no means imply the end for tech startups, they do imply a shifting environment with more fiscal and creative restriction.

Tech startups can make the best of the new economic situation in three ways:

Tech startups can make the best of the new economic situation in three ways:

- Shifting to risk-aware messaging

- Expecting lower burn multiples

- Planning for longer investment cycles

Why interest rates and inflation are so high

Like any economic phenomenon, it is impossible to point to a single cause for the current state of affairs. To get a better sense of what’s happening, we should overdetermine the causes- look at all the possible factors that are making current conditions.

The most often cited cause is the pandemic and the stimulus money handed out to help mitigate it. The pandemic induced supply chain shocks that increased prices for commodities across the board. And it is true that adding money to the money supply can increase inflation.

But the bigger picture is complicated. Economists use a 4-variable equation to predict price levels, and while the size of the money supply is one variable, the outcome is also affected by factors like the velocity of money. Stimulus money alone did not cause inflation.

Another cause is the labor shortage. This is another phenomenon that gets more complicated the more you look into it. Part of it has to do with workers’ increased bargaining power. Part of it has to do with the fact that manufacturing is growing rapidly in the United States, which creates huge demand for jobs.

Another factor is geopolitical. The invasion of Ukraine is a tragedy. While our problems in America are nothing compared to the suffering of the Ukrainian people, the effects of the conflict have had an impact on our economy. In particular, it has restricted global energy supplies, which affects the price of everything.

A final, often overlooked factor, is demography. The Baby Boomers, born between 1945 and 1963, are the largest demographic cohort in US history, and their financial habits are affecting inflation.

If you do the math, you will realize that the Boomers are aging into retirement age right now. Upon retirement, people lose their main source of income, and become more conservative in their investments. They shift to low-risk options like treasury bonds. Because the Baby Boomer cohort is so massive, and because they are all moving their money into safer investments right now, money is harder to get all across the board.

Less Capital Means Less Appetite For Risk

When money is tighter, it pays less to invest in risky investments.

Over 90% of startups fail. But those that succeed can create wildly high returns for investors. That makes them a high risk / high reward investment class.

When interest rates are low, borrowing money is cheap. Investors can tolerate investing in risky startups, because they can afford the interest if the startup goes under. But when interest rates are high, risky startups become a less attractive option.

One consequence of this is that the startups that do get funded will tend to the be the ones that appear less risky to begin with. Founders can take advantage of this by shifting their messaging from a focus on the size of the potential returns, to a focus on proving that the risk of their startup is relatively low.

While startups are, in general, a risky class of investments, they are not all on the same level of risk. Painting your business as having a sober, well-thought-out business plan can go a long way in securing funding.

Expect Lower Burn Multiples

The Burn Multiple is a measure of how much revenue you generate per dollar spent. It is literally a measure of the value produced by burning through cash.

In the past, investors might have ignored a high burn multiple if they thought your startup had the potential for a high return anyway. Today, investors are more wary about burning cash, and may be suspicious of a burn higher than 2x.

Plan For Longer Investment Cycles

It’s a sign of strength if your startup can survive for a long period of time on a single round of funding. It signals that your core business is not fragile, and that you as a founder are capable of planning for the long term.

Consequently, investment cycles will become longer, as appetite for investing wanes in general, and as investors flock to businesses that have proven their ability to survive for the long term.

Think Adjustment, Not Collapse

Startups are not going away. At worst, only the riskiest and most poorly thought out startups will go away.

This is a sign that the VC market is adjusting, not collapsing. And you can adjust with it to make sure that your startup succeeds.

Meanwhile, the fundamentals of business never change. You need a quality product to sell, and devoted customers to sell to.

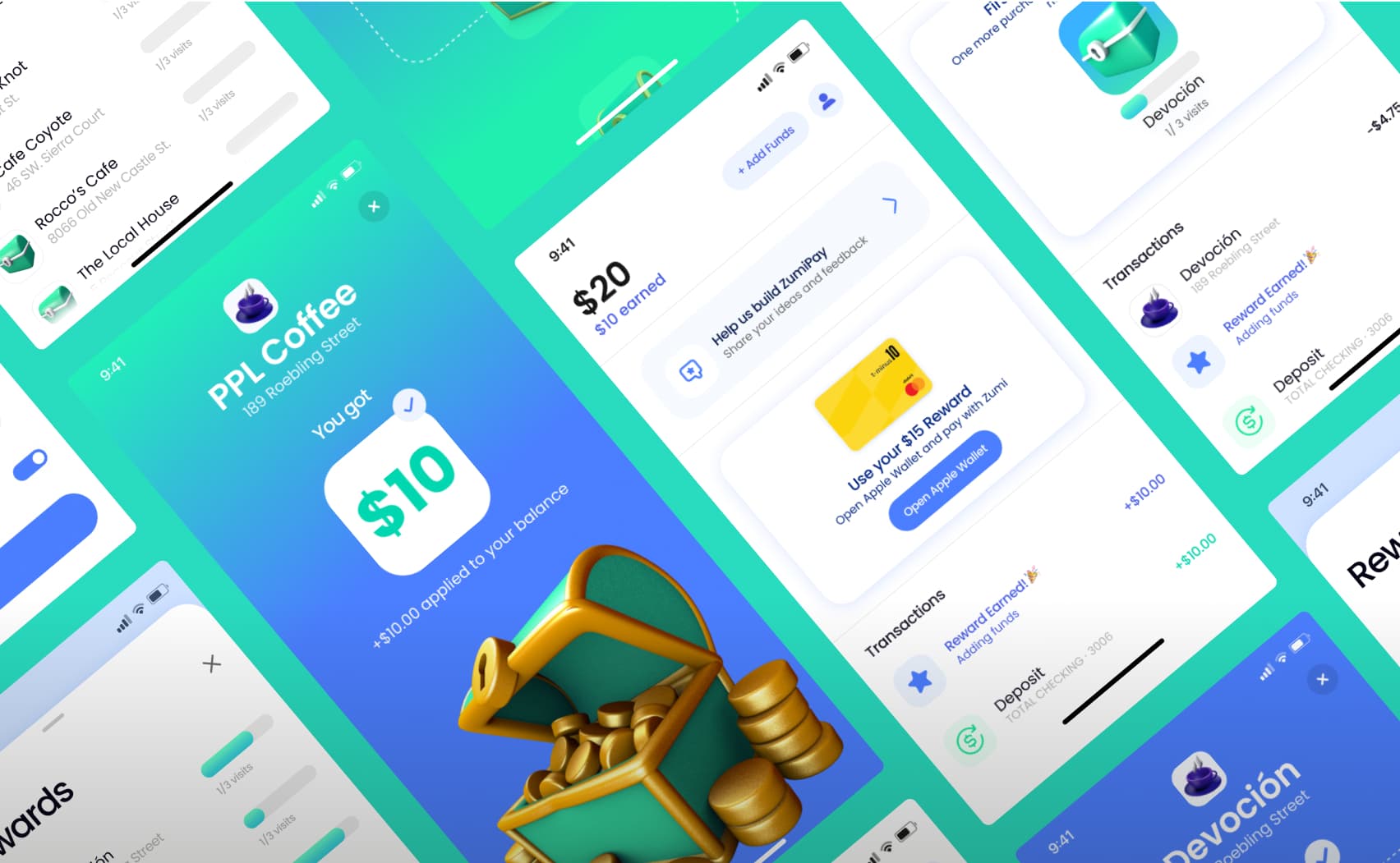

My firm, JetRockets, works with many startups to produce high quality, custom websites and web apps to fit their needs. We work by aligning our goals to yours to deliver the best outcome possible. If you are interested in learning more, drop us a line.