Technical Aspects of Algorithmic Trading. Part #1

As a practitioner in algorithmic trading over the last five years, I’ve gained a lot of relevant experience that could be helpful to other participants in the field. That’s why I would like to publish a series of articles describing my experience, problems I’ve encountered during my journey, and the ways in which I solved them.

Let me start by describing the fundamental concepts of trading, and we will dive into more technical aspects in the articles that follow.

Markets

There are a lot of different markets that exist today where you can try to win a fortune through trading activity. The most obvious is the stock market, but you can also trade bonds, options, cryptocurrencies, gas, oil, and other commodities. All of them have unique dynamics and characteristics. Since each trader has preferences and attitudes, different markets could attract different people. For example, I’m intensely interested in stock and crypto markets, while a good friend of mine prefers to trade commodities such as corn and grain, and crudes like oil and gas.

But despite the market you choose, you will deal with some of its parameters which will help you to achieve your financial goals. The most important, however, could be your asset's price and traded volume.

Trading systems

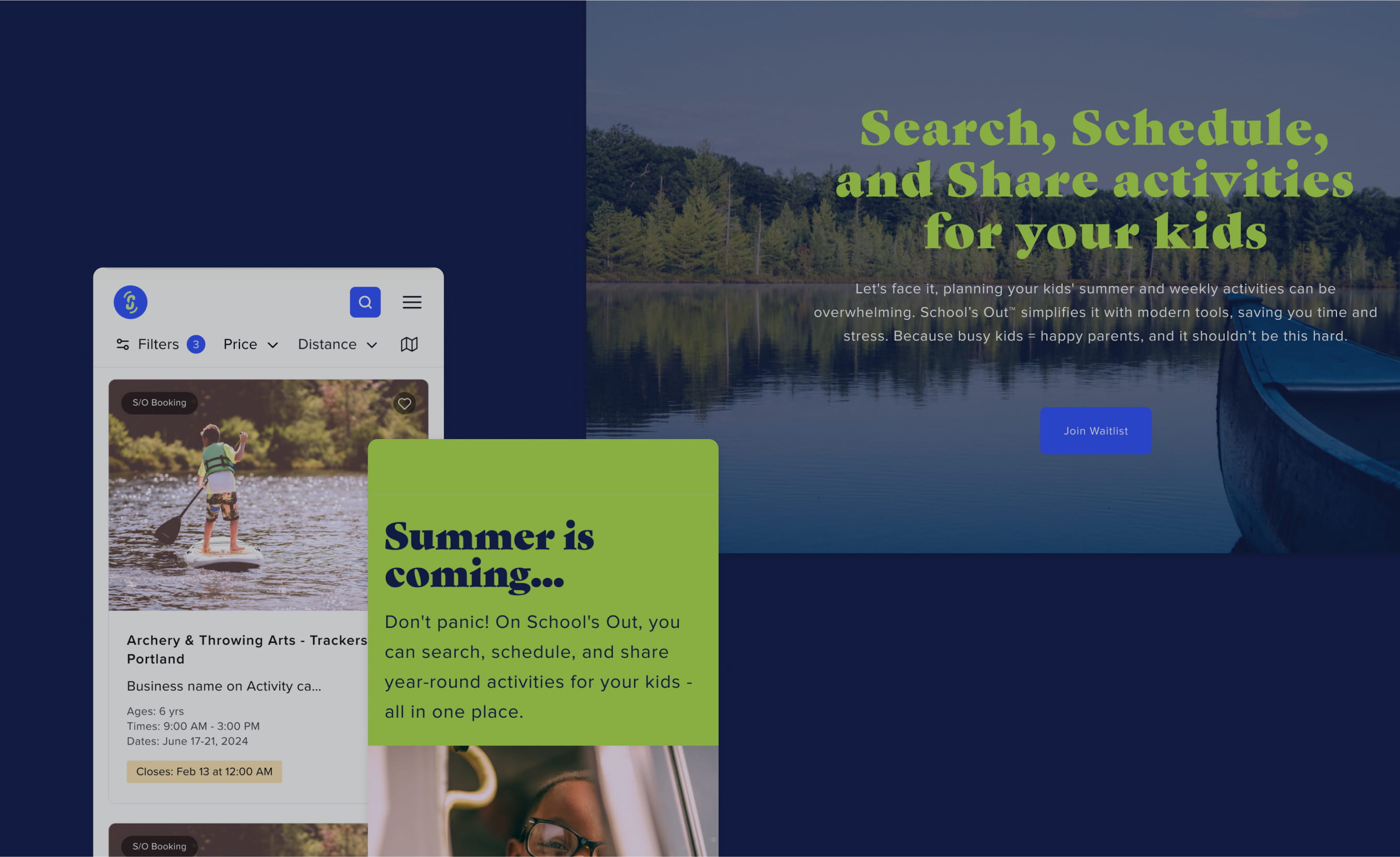

To make trade operations, you need a way to interact with the market. In the distant past, buy and sell orders used to be placed via telephone, but of course, nowadays, we have plenty of convenient software at our service. This type of software is called a trading terminal. There are many of them, but they all could be divided into three large groups:

- Desktop applications (Windows, Mac, Linux)

- Web applications

- Mobile applications

Metatrader 5

This enables you to easily trade from home, office, and on the go. All you need is a strong Internet connection since trading heavily depends on vast amounts of data transmitted between an exchange and your device.

Dealer vs. Broker

In the world of trading, whether it’s stocks or cryptocurrencies, intermediaries play a crucial role in connecting the trader to the market. Two key players in this process are brokers and dealers.. The main difference is the following:

- A broker executes orders on behalf of its clients

- A dealer facilitates trades on behalf of itself

For a trader, this difference means a simple but significant thing: brokers cannot alter the market you’re working on, while dealers can do this legally. You can read more details about this distinction here.

Working hours

Each organization should have its working hours while keeping some time for rest, right? Well, for financial markets, this is only half true.

The traditional stock market has its working and non-working hours. Generally speaking, you can trade assets on working days on labor hours, but you can’t trade during nights or on holidays.

However,for crypto markets, this is not true. There is no such thing as holidays here. You can trade crypto 24/7, 365 days a year, which makes this market attractive for people who don’t like to wait for holidays or breaks – this is why I prefer crypto over stocks.

Ticks and candles

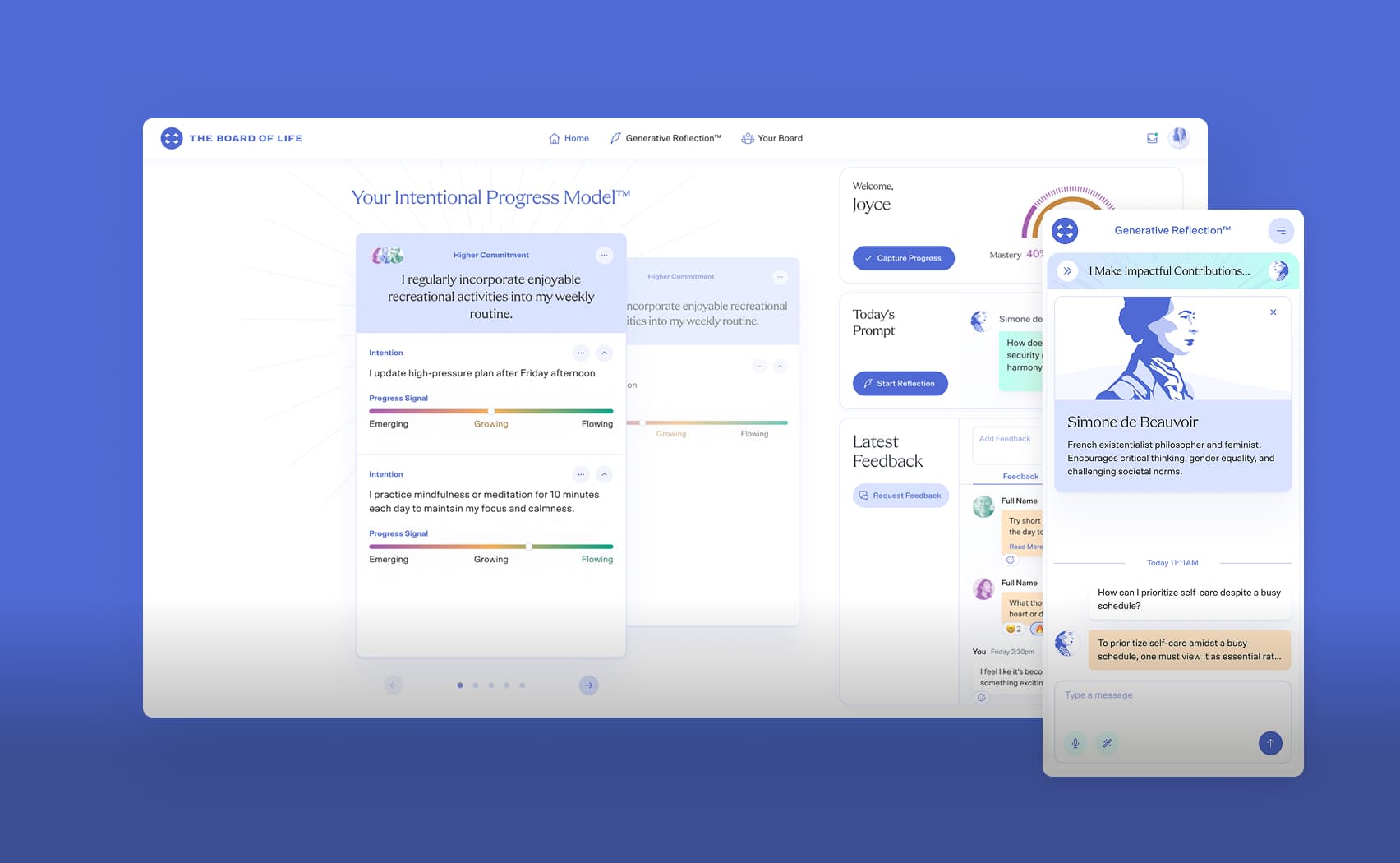

More likely than not, you would be interested in the price dynamics of your chosen asset. Traders often use price charts which could be one of two base forms:

- Tick chart

- Candle chart

Trading - Ticks and candles

Trading - Ticks and candles

Tick chart

A tick is a point on the chart corresponding to the concrete price of the instrument for a specific time. A new tick is generated every time the price moves up or down. So a tick chart is full of ticks, as simple as it sounds.

While such a type of chart could provide some insights regarding the movements of the market, many traders prefer candlestick charts over tick charts, and this is why.

A candle is a four-point data structure describing the price behavior for a given period of time. The four points include:

- Open price

- Highest price

- Lowest price

- Close price

An important concept here is a timeframe. A timeframe is a period of time for one candle, and it could be anything starting from one minute to one year. The most popular timeframes are:

- 1H (one hour)

- 1D (one day)

- 1M (one month)

Trading - Candle chart

Trading - Candle chart

Candle chart

So if you’re using candle charts, you have aggregated information regarding the price movement. You can freely choose any available time frame, which makes this type of chart very informative. You can read more regarding candle charts and how to read them here.

Conclusion

So in this short article, we discussed fundamental concepts of trading. We learn the following essential things:

- There are a lot of different markets, including stocks, bonds, crypto, commodities, raw materials, and many more. What works for others, may not work for you, and vice versa.

- A trading terminal is a software that helps you watch the markets and make trades. It could be an application on your computer, a website, or a mobile application.

- It’s very important to distinguish an intermediary between you and the market of choice. If it’s a dealer, you should understand that its information about market conditions could differ from other sources.

- While the more old-fashioned stock market is working only on working hours and having rest on nights and holidays, crypto markets are always available for operations.

- Any trader's essential skill is reading price charts of the asset you wish to trade. Depending on your needs and trading strategies, you can choose from tick charts and candle charts.

Thank you very much for reading! We will dive into more technical stuff, such as algorithmic trading and API usage, later. Stay tuned!

P.S. Feel free to contact me via email if you have any questions alexey.chernysh@jetrockets.com

P.S. Feel free to contact me via email if you have any questions alexey.chernysh@jetrockets.com